Key Takeaways

- The Scale of Secession: Meta’s 6.6 GW portfolio is roughly equivalent to the entire power consumption of Northern Virginia’s Data Center Alley as of 2024.

- The Tech Spec: The deal bets heavily on Sodium-Cooled Fast Reactors (SFRs) from Oklo and TerraPower, moving beyond traditional Light Water Reactors.

- The “Shadow Utility” Thesis: By securing dedicated nuclear generation, Meta is effectively defecting from the public grid’s reliability pool, creating a two-tiered energy system.

- The Physics of Uprates: 433 MW of the capacity comes not from new plants, but from squeezing thermal efficiency out of 1980s-era reactors.

The Louisiana Purchase of Electrons

On paper, Mark Zuckerberg runs a social media and advertising company. In physical reality, he has just become the CEO of a mid-sized electric utility.

Meta’s announcement of a 6.6 gigawatt (GW) nuclear power portfolio puts the scale of the AI infrastructure buildout into terrifying perspective. To visualize 6.6 GW, you have to look beyond corporate deals and start looking at nation-states. It is more than the installed nuclear capacity of Switzerland. It is enough power to run 5 million US homes. And critically, it substantially exceeds the entire estimated power load of Northern Virginia’s Data Center Alley (~4 GW) as of 2024.

But the headlines focusing on the “Green AI” narrative are missing the structural coup. This isn’t just a Power Purchase Agreement (PPA) to buy credits from a solar farm in Arizona. This is an acquisition of sovereignty.

By locking in 2,609 MW of existing commercial nuclear generation from Vistra and betting billions on next-generation Small Modular Reactors (SMRs) from Oklo and TerraPower, Meta is effectively seceding from the public electricity market. They are building a “Shadow Utility,” a private, parallel infrastructure designed to survive the very grid instability that AI itself is causing.

The Hardware: Beyond Boiling Water

To understand why this deal matters, you have to understand the physics of what Meta is buying. They aren’t just buying “nuclear”; they are buying a specific quality of electron, thermal reliability, and they are placing bets across three distinct technologies.

1. The Workhorses: Perry and Davis-Besse (Vistra)

The core of the deal (the 2,176 MW of “operating generation” starting in late 2026) comes from Vistra’s legacy fleet in the PJM Interconnection (Ohio and Pennsylvania). These are Light Water Reactors (LWRs), the Toyota Camrys of the nuclear world.

- Perry Nuclear Power Plant: A General Electric Boiling Water Reactor (BWR).

- Davis-Besse: A Babcock & Wilcox Pressurized Water Reactor (PWR).

These plants operate on the Rankine cycle, using uranium fission to heat water into steam, which spins a turbine. It’s 1970s thermodynamics, but it is firm. Unlike solar (capacity factor ~25%) or wind (~35%), these plants run at 92%+ capacity factors. For an AI model training run that takes nearly 100 days to complete, a millisecond of intermittency is a catastrophe. Meta is buying the guarantee that the lights stay on.

2. The Efficiency Hack: Total System Reconstruction

Perhaps the most fascinating slice of the deal is the 433 MW of “new” power that Vistra will deliver by 2034. This doesn’t come from building new reactors, but from aggressive Extended Power Uprates (EPU).

An uprate is not just turning a dial. To squeeze 433 MW (nearly 20% more output) from existing plants, Vistra will likely have to perform massive physical surgery. This goes far beyond the typical “Measurement Uncertainty Recapture” (upgrading sensors to gain ~1.5%).

Getting 400+ MW requires replacing high-pressure turbines, rewinding electric generators, upgrading condensate pumps, and reinforcing steam dryers to handle higher flow rates. They aren’t just trading information for energy; they are effectively rebuilding the non-nuclear side of the plant to run hotter and harder than the original 1980s design ever intended. They are treating these plants like hot-rods, boring out the cylinders to maximize horsepower for the AI race.

3. The Bets: Oklo and TerraPower (SFRs)

The remaining ~4 GW of the “up to 6.6 GW” target relies on unproven, next-generation tech. This is where Meta transitions from “Utility” to “Venture Capitalist.”

TerraPower’s Natrium Reactor: Backed by Bill Gates, Natrium is a Sodium-Cooled Fast Reactor (SFR). Instead of water, it uses liquid sodium metal as a coolant.

- The Physics: Sodium boils at roughly 880°C, while water boils at 100°C. This allows the reactor to run at atmospheric pressure (safer) but much higher temperatures (~500°C).

- The Spec: Each unit provides 345 MWe nominal output.

- The Storage Trick: It couples the reactor to a molten salt thermal storage tank. This allows it to “boost” output to 500 MWe for 5.5 hours during peak demand—acting like a grid-scale battery that never runs out of charge.

Oklo’s Aurora: Oklo is the minimalist of the group.

- Size: 15 MWe to 75 MWe micro-reactors.

- Fuel: HALEU (High-Assay Low-Enriched Uranium) metal fuel.

- Design: It uses heat pipes to passively move heat, eliminating pumps and valves. It is designed to look like an A-frame ski lodge, not a power plant, and sits “behind the meter” directly at data center sites.

The Theory of the Shadow Utility

Why go to all this trouble? Why not just buy more solar credits?

The answer lies in the concept of Grid Defection. The US power grid is currently facing a “load growth” crisis not seen since World War II, driven by three forces:

- AI Data Centers (The DeepSeek factor)

- Electric Vehicles (The charging spike)

- Industrial Electrification (Heat pumps/factories)

In regions like PJM (where Vistra operates), the interconnection queue—the line to plug new power plants into the grid—is years long. The grid is becoming congested, fragile, and politically volatile.

By signing a 20-year PPA for nuclear, Meta is effectively privatizing reliability.

The Two-Tiered Grid

The market is witnessing the bifurcation of the American energy system:

- Tier 1 (The AI Tier): Powered by co-located nuclear and firm gas. High cost, 99.999% reliability, immune to weather and rate cases. Owned by Meta, Microsoft, Amazon.

- Tier 2 (The Public Tier): Powered by a mix of renewables and aging fossil assets. Subject to congestion pricing, curtailment, and “demand response” events (blackouts). Used by you, your refrigerator, and your local hospital.

When Meta buys 2,176 MW of existing nuclear capacity, that is 2,176 MW of firm power that is no longer available to balance the public grid during a polar vortex. While Vistra claims grid benefits, the economic reality is that the highest bidder has captured the highest quality asset.

The Regulatory Capture by Contract

The “Standard Oil” parallels here are unavoidable. Meta is vertically integrating into its supply chain because the market cannot provide what it needs.

This deal provides Vistra with the one thing utilities crave more than money: Certainty. With a 20-year revenue guarantee from a trillion-dollar company, Vistra can now march to the NRC and demand license extensions for Perry and Davis-Besse into the 2050s.

This is “regulatory capture by contract.” The sheer size of the Meta deal forces regulators’ hands. You cannot simply shut down a plant that powers the critical infrastructure of the American AI sector. By entangling national competitiveness (AI dominance) with specific nuclear assets, Meta ensures those assets are protected by the state.

What’s Next?

Short-Term (2026-2027)

Expect a scramble for remaining nuclear assets. Constellation and Public Service Enterprise Group (PSEG) are now holding golden tickets. Every other hyperscaler (Google, Oracle) is looking at the Vistra deal and panicking. The price of “firm clean power” just doubled.

Medium-Term (2028-2030)

Watch for the interconnection wars. If Oklo tries to site a 75 MW reactor next to a data center in a suburb, the zoning battles will make the 5G tower fights look like a tea party. The NIMBY opposition will meet the “National Security” imperative.

Long-Term (2034+)

If the Natrium and Oklo bets pay off, Meta will have successfully incubated a new energy industry. If they fail, plagued by cost overruns and sodium leaks, Meta will still have its Vistra contracts, leaving the public to clean up the venture capital mess.

What This Means for You

If you are a Ratepayer: Your bill is about to get more volatile. As big stable loads like data centers defect to their own private nuclear islands, the fixed costs of the public grid are spread over fewer “standard” customers. The “Shadow Utility” doesn’t pay for the transmission lines it doesn’t use.

If you are an Investor: The signal is clear: Firm Power is the scarcity trade of the decade. Long nuclear operators (Vistra, Constellation), uranium miners, and the industrial engineering firms that do uprates. Short generic renewables that lack storage.

If you work in Tech:

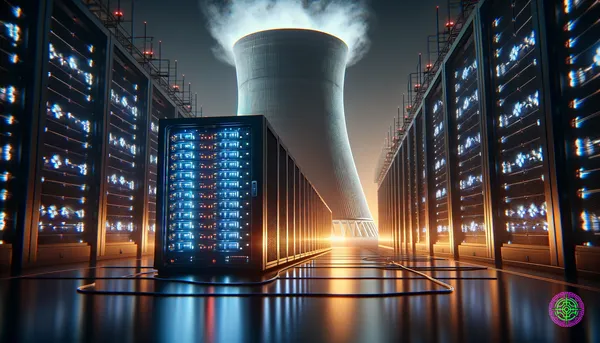

Your code is no longer abstract. Every parameter count increase in Llama-5 is a direct demand for uranium enrichment. The era of “software eating the world” is over. Software is now heating the world, and it needs a cooling tower to survive.

🦋 Discussion on Bluesky

Discuss on Bluesky