On February 10, 2026, in a quiet press release from Ojai, California, the world’s largest automaker effectively admitted defeat.

Toyota, the company that has spent the last five years lobbying against electric vehicle mandates, running “Electrified” ads that blur the line between hybrids and BEVs, and promising a “Multi-Pathway” future where combustion engines survive for decades, did the unthinkable. They announced that the 2027 Toyota Highlander, the generic, appliance-like backbone of American suburbia, will drop its gas engine. It will drop its hybrid powertrain. It will become a pure Battery Electric Vehicle (BEV).

If you are just reading the headlines, this looks like a product update. It isn’t. It is a capitulation.

The Highlander is not a niche car. For two decades, it has been the default choice for upper-middle-class families who want reliability, not revolution. By stripping it of the very hybrid technology that Toyota pioneered, the company is signaling that the era of “Hybrid Forever” is mathematically over.

But Toyota didn’t do this because they saw the light. They did it because they ran out of math.

The Collapse of the Middle Child

To understand why Toyota killed the gas Highlander, the sales sheet tells the story. It is a bloodbath.

The market bifurcated. If you wanted gas, you bought the big Grand Highlander. If you wanted tech, you looked at Korea. The standard Highlander had no reason to exist.

The Regulatory Cliff: CARB 2027

The real gun to Toyota’s head, however, isn’t sales. It is the law. Specifically, the Advanced Clean Cars II (ACC II) regulations from the California Air Resources Board (CARB).

While the Trump administration rolled back federal EPA GHG standards earlier this month, the legal reality is stickier. CARB’s authority, while under attack, still dictates the product planning for the “ZEV States” (Zero Emission Vehicle) that make up over 30% of the US auto market.

Starting in Model Year 2027, the ACC II regulation ramps up the mandatory ZEV percentage significantly. Toyota heavily relies on its fleet of hybrids (HEVs) to lower its average emissions, but under the new rules, standard hybrids stop counting towards ZEV credits. Only BEVs and Plugin Hybrids (PHEVs with 50+ miles of range) generate the credits needed to sell gas trucks like the Tundra and Tacoma without massive fines.

The math is brutal.

- The Bad Credits: Every Tundra, Sequoia, and Grand Highlander sold creates a massive emissions “debt.”

- The Old Offset: Ideally, you sell a bunch of Prius Primes or bZ4Xs to offset that debt.

- The Failure: The bZ4X has been a commercial flop, and the Prius is too low-volume to offset the massive truck sales.

Toyota needed a volume seller to be a BEV. They couldn’t convert the RAV4 because it sells too well as a gas car. They couldn’t convert the Camry due to price sensitivity. The Highlander was the perfect sacrificial lamb. Its sales were already dying, its customers had already migrated to the Grand Highlander, and the chassis was ready for a refit.

By turning the Highlander into a BEV-only model, Toyota solves two problems. They euthanasia a dying gas model, and they create a compliance machine capable of generating the tens of thousands of ZEV credits needed to keep selling the gas-guzzling Grand Highlander and Tundra.

The “Multi-Pathway” Lie

For years, Toyota executives, from Akio Toyoda down, have argued for a “Multi-Pathway” approach. “The enemy is carbon, not the engine,” they said perfectly rehearsed lines at every auto show. They argued that a fleet of hybrids does more for the planet than a few expensive EVs.

There is scientific merit to that argument. But the market and the regulators have moved on.

The 2027 Highlander EV proves that “Multi-Pathway” was never a philosophy. It was a delay tactic. When the regulatory bill finally came due, Toyota didn’t double down on hydrogen. They didn’t inventing a magical carbon-neutral synthetic fuel engine. They did exactly what Tesla, Hyundai, and Volkswagen did years ago. They built a skateboard EV.

The irony is palpable. The company that ran “Self-Charging Hybrid” ads, implying that plugging in was a burden, is now asking its most loyal family buyers to plug in.

A Bet on Segmentation

This move clarifies Toyota’s strategy for the rest of the decade. They are effectively splitting their lineup into two distinct companies.

- Toyota Legacy (Gas/Hybrid): This division will sell the Grand Highlander, Sequoia, Tacoma, and Tundra. These are the profit centers. They will remain hybrid to meet federal CAFE standards but will rely on “credits” to survive in ZEV states.

- Toyota Future (BEV): This division now includes the Highlander EV, the bZ4X (if it survives), and upcoming Lexus electrics. Their primary job is not necessarily profit. It is compliance. Their existence allows the Legacy division to survive.

Technical Analysis: 400V in an 800V World?

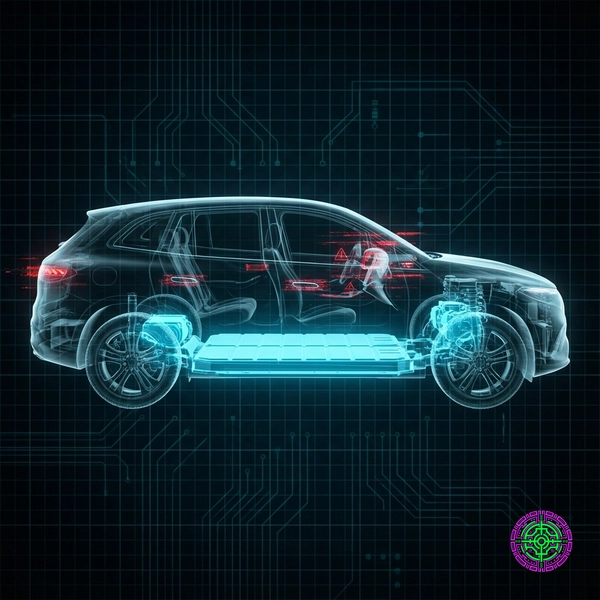

One of the most critical questions surrounding the 2027 Highlander EV is its architecture. While Toyota has not confirmed specific voltage numbers, industry analysis suggests it is built on a modified version of the TNGA-K platform (which underpins the gas RAV4 and Camry) rather than a dedicated EV platform.

Based on the reported charging times—30 minutes to 80%—it is highly likely this system utilizes a 400-volt architecture.

Why does this matter? Because its primary competitors, the Kia EV9 and Hyundai Ioniq 9, run on the E-GMP 800-volt architecture.

In practical terms, voltage determines charging speed. The 800V Korean SUVs can charge from 10% to 80% in roughly 20-24 minutes, peaking at over 230 kW. A 400V system, like that in the current bZ4X or Tesla Model Y, typically takes 30-40 minutes to achieve the same state of charge, often peaking around 150 kW to 185 kW.

If the Highlander EV launches with 400V architecture in 2027, it will be technically obsolete on Day 1. Families on road trips care about “dwell time” at chargers. An extra 15 minutes per stop doesn’t sound like much until you have screaming toddlers in the back seat. By 2027, nearly every premium EV will be pushing 800V or 900V (like Lucid). If Toyota sticks to 400V to save costs, they are betting that their brand loyalty is stronger than the physics of electron flow.

Furthermore, the battery size, reported at 95.8 kWh for the AWD trim, is substantial. Moving that many electrons into a pack at 400V generates significantly more heat than at 800V, requiring more robust cooling systems and potentially throttling charge speeds in hot weather. This has been a known pain point for the bZ4X. If Toyota hasn’t solved the thermal management/charging curve issues, the Highlander EV could face the same “Slow Charging” reputation that killed early interest in the bZ4X.

The Dealer Rebellion

The other silent war happening behind this announcement is with the dealer network. Toyota dealers have been arguably the most anti-EV lobby in the entire retail automotive sector.

The reason is simple economics. A gas or hybrid Highlander has thousands of moving parts. It needs oil changes, transmission fluid flushes, timing belts, and spark plugs. This “fixed operations” (service) revenue accounts for nearly 50% of a dealership’s gross profit.

An electric Highlander kills that golden goose. It has no engine oil. It has no transmission fluid (in the traditional sense). It uses regenerative braking, so brake pads last 100,000 miles. By forcing their volume family hauler to be electric, Toyota is effectively handing their dealers a pay cut.

This explains why the Grand Highlander exists. It is the peace offering. Dealers get to keep selling high-margin, service-intensive gas cars to the “never EV” crowd, while Toyota corporate forces the EV Highlander onto the lot to meet the ZEV mandates. Expect to see “Market Adjustments” on Grand Highlanders and mysterious “inventory shortages” of the EV version as dealers prioritize the cars that keep their service bays full.

The Verdict

The 2027 Highlander is the canary in the coal mine. It signals that the industry has reached the point where legacy automakers can no longer “efficiency” their way out of the transition. You can’t hybridize a Tundra enough to offset its footprint in a ZEV World. Eventually, you have to sell zero-emission vehicles, at scale, whether you want to or not.

Toyota blinked. And because they blinked, the American three-row SUV market is officially electric. The “Hybrid King” just abdicated its throne to save its kingdom.

But will the kingdom accept the new ruler? The 2027 Highlander EV enters a market that is no longer empty. It enters a ring occupied by the award-winning Kia EV9, the sleek Hyundai Ioniq 9, and the upcoming Rivian R2. Toyota is no longer the innovator here; they are the chaser. They are betting that the badge on the nose is enough to make up for a five-year deficit in EV development. It is a gamble that will define the company’s future in North America.

🦋 Discussion on Bluesky

Discuss on Bluesky