On January 1, 2026, the global silver market essentially broke. It wasn’t a flash crash or a mining disaster; it was a bureaucratic signature in Beijing. By shifting silver exports from a quota system to a strict “qualification” license, China (which refines nearly 60% of the world’s supply) did not merely tighten the tap; the nation claimed ownership of the plumbing.

But while the financial press obsesses over the “industrial deficit” (which the Silver Institute pegs at 117 million ounces this year), analysts are missing the darker, more permanent phenomenon driving the shortage. This phenomenon is best described as the Vaporization Rate.

In a peace economy, silver is borrowed. It goes into a phone or a solar panel, lives there for 15 years, and is eventually recovered by a recycling smelter. In a war economy, silver is deleted. It is fired into a hillside, sunk into the ocean, or vaporized in an explosion.

The world is entering the first era in history where its primary strategic metal is being permanently removed from the supply chain at industrial scale.

The Physics of Deletion

To understand why the 2026 shortage is different, it is necessary to understand the distinction between Recoverable Use and Consumptive Use.

Recoverable Use: The Solar “Bank”

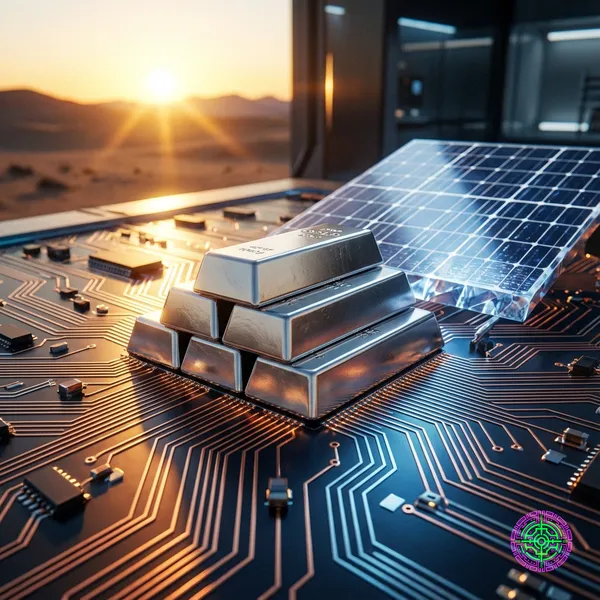

The standard narrative maintains that the Green Transition is draining silver stocks. It is true that a standard photovoltaic panel uses about 20 grams of silver paste. With global installations hitting record highs, this accounts for roughly 15% of total supply.

However, this silver isn’t gone; it is effectively vaulted. A solar farm is effectively a distributed silver mine that will “open” in 20 years when the panels are decommissioned. The metal is chemically stable, solid, and sitting in broad daylight.

Consumptive Use: The Kinetic Sink

Military applications operate on an entirely different set of physics. Modern kinetic warfare relies on the Silver-Zinc (Ag-Zn) battery. These power sources are the unsung heroes of the torpedo and cruise missile world.

Why silver-zinc?

- Energy Density: They pack 40% more energy per unit volume than Li-ion, critical for extending the range of a Mark 48 torpedo without increasing its hull diameter.

- Safety: They do not experience thermal runaway (fire) like lithium, a non-negotiable requirement for a battery sitting inside a submarine tube or a missile silo.

- Discharge Rate: They can dump massive current instantly to power the guidance fins and active sonar of a weapon traveling at Mach speeds.

When a heavyweight torpedo is fired in a training exercise, the Navy recovers it. The battery is 97% recycled. But when that same torpedo is fired in combat, or when a cruise missile detonates its payload, the 15+ ounces of silver in its guidance and propulsion systems are effectively atomized. The heat of detonation and the scattering of debris make recovery economically and physically impossible.

Every Tomahawk fired is a withdrawal from the global silver vault that will never be deposited back.

The 2026 Supply Shock: Weaponizing the Smelter

The timing of China’s January 1st export restriction is surgical. By designating silver a “dual-use” item (civilian and military), Beijing has tacitly acknowledged what defense contractors have known for years: Silver is a weapon component.

The new rules require exporters to prove “end-user” certification. Only 44 companies have received qualification licenses for the 2026-2027 period, a dramatic reduction from the previous open market. If a US defense contractor is trying to source refined silver for guidance chips, they now face a regulatory firewall.

The math is brutal:

- Global Deficit: ~117 million ounces (projected 2026).

- China Control: ~60% of refining capacity.

- Military “Burn Rate”: Classified, but rising linearly with global tension.

The market is witnessing a repricing of silver not as a “precious metal” like gold, but as a “strategic combustible” like oil or gunpowder.

The Recycling Illusion

A common counter-argument is that high prices will incentivize recycling. While true for jewelry and silverware, this logic fails on the battlefield.

Consider the lifecycle of consumer electronics. E-waste recycling rates globally hover around 22.3%. Even with that low number, the silver in a discarded iPhone exists in a concentrated, recoverable form.

Now consider the lifecycle of a munition. A guided artillery shell uses silver contacts in its fuze. When that shell impacts, the silver is scattered across a blast radius of 50 meters, mixed with dirt, shrapnel, and unexploded ordinance. The “ore grade” of a battlefield is effectively zero. No scavenger is going to sift through a crater to recover 0.5 grams of silver dust.

This is the Vaporization Coefficient: The percentage of material that is permanently lost during its use phase.

- Silver Coin: 0% (Stored)

- Solar Panel: <5% (Recyclable)

- Cruise Missile: 100% (Vaporized)

The Historial Rhyme: 1942 vs. 2026

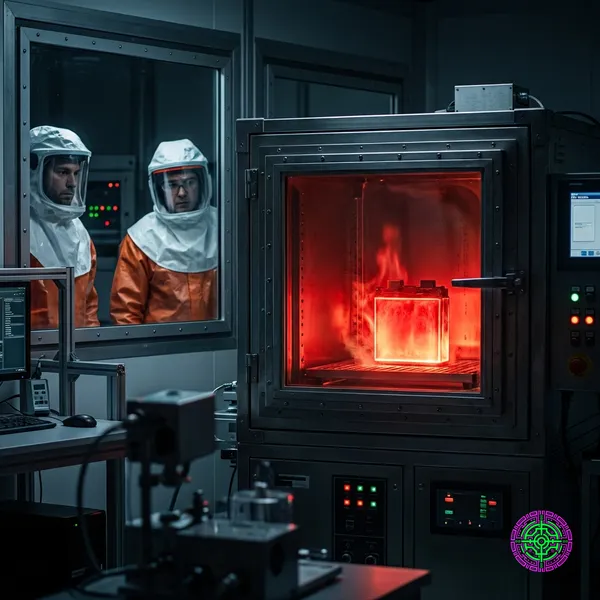

History offers a haunting parallel, but with a twist. In 1942, the Manhattan Project hit a wall. The engineers needed massive electrical conductors for the “calutrons” at Oak Ridge to separate uranium. Copper was too scarce, needed for shell casings.

So, the US Army went to the Treasury. They didn’t ask for money; they asked for the silver. The Treasury loaned the Manhattan Project 14,700 tons (430 million ounces) of silver bullion. It was melted down, drawn into wire, and used as busbars for the electromagnets.

Here is the key difference: It was a loan.

Throughout the war, armed guards watched those magnets. When the war ended, the silver was dismantled and returned to the Treasury. The final accounting in 1970 showed that less than 0.036% was lost.

In 2026, the world does not have that luxury. The nature of technology has shifted from infrastructure (magnets) to munition (missiles). The military is not building liquid assets; it is building expendable ones. The silver loan of 1942 built the bomb; the silver purchase of 2026 is the bomb.

The Cannibalization of Green Tech

This dynamic creates a zero-sum game between two existential priorities: Decarbonization and Rearmament.

Defense contracts are typically inelastic. If Raytheon needs silver for a guidance system, the company will pay roughly any price. A $100/oz silver price adds $1,500 to the cost of a $2 million missile—a rounding error. The Pentagon has “DO” rated orders under the Defense Production Act (DPA), which legally forces suppliers to fill their orders before civilian customers.

Solar manufacturers, by contrast, operate on razor-thin margins. If silver jumps to $50/oz, the levelized cost of energy (LCOE) for a new solar farm spikes. A 500MW solar project operates on a spreadsheet where a 10% increase in module cost makes the project unfinanceable.

The “Vaporization Rate” of war suggests that the defense sector will cannibalize the green energy supply chain. The industry is likely to see “Strategic Allocation” orders in late 2026, where domestic silver production is routed to aerospace primes first, leaving solar installers to fight for scraps on the restricted international market.

The Investor’s Paradox: Paper vs. Metal

This physical reality creates a dangerous divergence for investors. For decades, the “paper price” of silver (futures contracts and ETFs) has been the benchmark. These instruments assume that silver is always available for delivery.

But in a “Vaporization” scenario, the paper market decouples from reality. If 15% of the annual supply is being chemically destroyed by defense consumption, the physical collateral backing those ETF shares does not exist.

We saw a preview of this in the nickel squeeze of 2022, but the silver squeeze of 2026 has a geopolitical accelerant. If Beijing restricts export licenses while Washington invokes the DPA to hoard domestic production, the liquidity of the global silver market evaporates. You might own a silver contract, but you cannot surrender it for a cruise missile battery. The metal is already spoken for.

Conclusion: The Periodic Table’s First Casualty

For decades, economists viewed resources as cyclical. Mining companies extract them, industry uses them, and recyclers recover them. But the combination of high-tech warfare and geopolitical fragmentation is breaking that cycle.

As observers watch the headlines of drone swarms and missile barrages in 2026, they shouldn’t just count the human or political cost. They should count the ounces. Nations are fighting wars with a finite element, turning a geological inheritance into dust, one detonation at a time. The world isn’t running out of money, but it might be running out of the periodic table.

🦋 Discussion on Bluesky

Discuss on Bluesky