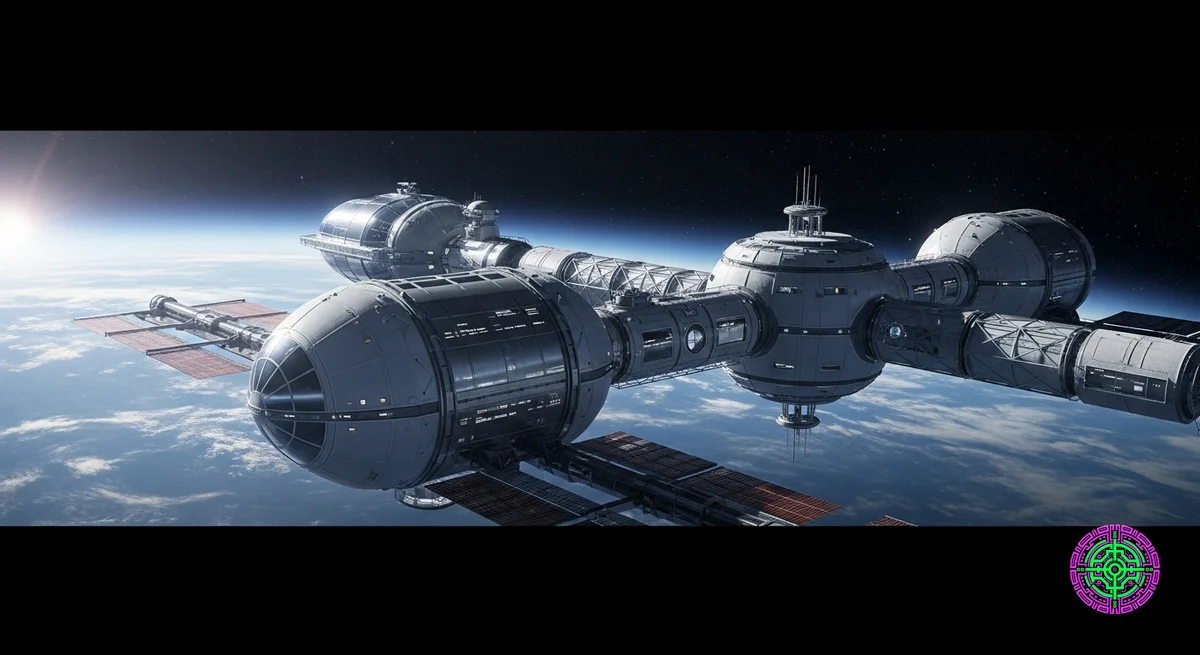

BREAKING (Dec 22, 2025): Starlab Space has successfully closed a major credit facility to fund the final development phase of its commercial station, signaling a massive vote of confidence from institutional lenders.

The International Space Station (ISS) is dying.

Launched in 1998, the football-field-sized laboratory has been the crowning achievement of international cooperation for nearly three decades. But structurally, it is a relic. Cracks are forming in the Zvezda service module. Seals are degrading. The hardware is tired. In 2030, NASA will pay SpaceX roughly $843 million to tow it into the atmosphere, where it will burn up over the Pacific Ocean.

This creates a terrified vacuum. For the first time in modern human history, there will be no government-run outpost in orbit. NASA has made it clear: they are getting out of the landlord business. They want to be tenants.

Welcome to the Commercial LEO Destinations (CLD) program. It is effectively a Request for Proposal (RFP) for the “Space Hotel” era. NASA wants to rent lab space, power, and astronaut berths from private providers. The race to build the first commercial space station is not just about science; it is a race for the most expensive real estate market in the solar system.

Three primary contenders have emerged from the chaos: the agile upstart (Vast Space), the corporate joint venture (Starlab), and the billionaire’s dream (Orbital Reef).

The Physics of Rent: Why This Market Exists

To understand the business model, you have to understand the cost of “life support” as a service.

Space is hostile. To keep a human alive, you need:

- Atmosphere: Maintaining 101.3 kPa of pressure and a 21% Oxygen mix.

- Thermal Control: Managing shifts from +250°F in sunlight to -250°F in shadow every 90 minutes.

- Power: Generating kilowatts of electricity via solar arrays to run experiments.

- Microgravity: The product they are actually selling.

Pharmaceutical companies need microgravity for protein crystallization (making purer drugs). Fiber optic manufacturers need it for ZBLAN (making clearer glass). These customers don’t care about the view; they care about the “rack space”—standardized slots for their hardware.

The winner of this race won’t just host astronauts; they will host the industrial base of the 21st century.

The Contenders

1. Vast Space: The Agile “First Mover”

- Station: Haven-1

- Launch Target: May 2026

- Launcher: SpaceX Falcon 9

While others were drawing PowerPoints, Vast Space was bending metal. Founded by crypto-billionaire Jed McCaleb, Vast has taken a “SpaceX-like” approach: build hardware, break it, and iterate fast.

Their station, Haven-1, is small—essentially a single module. But it has a critical advantage: it fits inside a standard Falcon 9 fairing. They don’t need the massive Starship to be fully operational.

As of July 2025, the primary structure of Haven-1 was complete. While originally targeting late 2025, they have shifted to a May 2026 launch window to align with NASA’s testing requirements. Vast is currently the betting favorite to put a private hull in orbit first. Their strategy is simple: lock in the early commercial backlog before the giants wake up.

2. Starlab: The Trans-Atlantic Heavyweight

- Station: Starlab

- Launch Target: 2029

- Launcher: SpaceX Starship

- Backers: Voyager Space, Airbus, Mitsubishi

Starlab is the “traditional” aerospace answer. It is a joint venture between Voyager Space and Airbus. Just today, December 22, 2025, they announced the closing of a major credit facility to push through the final design phase—a critical milestone that separates them from the “paper rockets” of competitors.

Starlab differs technologically. It is a single-launch inflatable. Instead of assembling modules like Legos (ISS style), Starlab will launch folded up inside a Starship and inflate to 340 cubic meters—half the volume of the ISS in one go.

The partnership with Airbus is strategic. NASA isn’t the only customer; the European Space Agency (ESA) needs a home too. By being “half-European,” Starlab is positioning itself as the default option for Western democracies.

3. Orbital Reef: The “Business Park” in Limbo?

- Station: Orbital Reef

- Launch Target: Late 2020s (Unclear)

- Launcher: Blue Origin New Glenn

- Backers: Blue Origin, Sierra Space

Blue Origin’s Orbital Reef was pitched as a “mixed-use business park.” It promised luxury tourism, movie studios, and research labs. It is the most ambitious design, utilizing Sierra Space’s “LIFE” (Large Integrated Flexible Environment) inflatable habitats.

However, recent reports suggest the project has lost momentum. Blue Origin has shifted heavy focus to its Lunar lander (Blue Moon) contracts. While NASA saw “progress” in design reviews mid-2025, Orbital Reef ranks last in urgency among analysts. It relies heavily on the New Glenn rocket, which is only just entering service. Without a reliable heavy-lift vehicle, the Reef stays on paper.

The Red Dragon in the Room: Tiangong

While US companies fight for capital and launch windows, the competition is already orbiting overhead. China’s Tiangong Space Station is fully operational, permanently manned, and expanding.

Unlike the ISS coalition, Tiangong is sovereign Chinese territory. However, Beijing has explicitly invited other nations to send astronauts and experiments to their station. For countries in the Global South—or even European nations frustrated by American delays—Tiangong offers an immediate alternative.

This creates a hard deadline for the West. If the ISS deorbits in 2030 and Haven-1 or Starlab aren’t ready, the only human outpost in space will be Chinese. NASA calls this the “Gap.” It is a diplomatic nightmare where the US loses its primary soft-power tool in orbit. The CLD program isn’t just about privatization; it is about preventing a monopoly on the high ground.

The Extension Myth: Why 2030 is Real

“Why not just extend the ISS again?” It is the most common question from the public, but engineers know the answer is metal fatigue.

The ISS isn’t just “old tech”; it is physically breaking. The Russian Zvezda service module—the structural backbone of the station—has been leaking air since 2019. Cracks are propagating through the aluminum alloy hull due to decades of thermal cycling (expanding and contracting every 90 minutes).

NASA’s own safety advisory panel has flagged these leaks as a “top safety risk.” patching them is like putting duct tape on a cracked submarine hull. While political will could theoretically fund an extension, physics has cast the deciding vote. The station must come down before it breaks apart uncontrollably. 2030 isn’t a calendar date; it’s an engineering expiration.

The Economics of a $100 Million Ticket

The business model for these stations relies on a mix of three revenue streams:

- Sovereign Astronauts: Nations without a space program (e.g., UAE, Turkey, Sweden) paying $50M-$100M to send a citizen to orbit for two weeks.

- NASA/ESA Contracts: Guaranteed annual leases for crew time.

- In-Space Manufacturing: The long-term play. If Varda Space Industries proves that manufacturing drugs in orbit is profitable, they will need factories. Haven-1 and Starlab want to be those factories.

The Verdict

The Space Real Estate market works like terrestrial real estate: Location is irrelevant (it’s all LEO), but timing is everything.

Vast Space is winning the timeline. By accepting a smaller station (single module), they will likely be the only game in town when the ISS starts decommissioning operations. They are the “AirBnB” of orbit—available, accessible, and ready.

Starlab is the “Hilton”—commercial grade, backed by institutional money, and designed for steady government contracts, but arriving later.

Orbital Reef risks becoming the “WeWork” of space—a grand vision that might be too capital-intensive to survive the harsh reality of launch physics.

For the investor, the signal is clear: Watch May 2026. If Vast Haven-1 reaches orbit and pressurizes successfully, the era of government monopoly on space is officially over. The rent is due.

🦋 Discussion on Bluesky

Discuss on Bluesky