On January 11, 2026, the Department of Justice dropped a bombshell that had been ticking since mid-2025: a criminal investigation into Federal Reserve Chair Jerome Powell. The charge? Alleged perjury regarding the escalating costs of the Federal Reserve’s headquarters renovation.

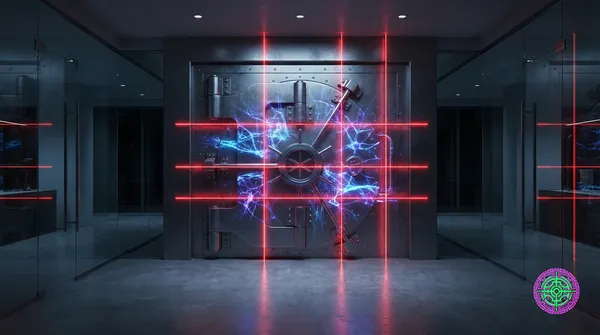

On the surface, this is a scandal about fiscal irresponsibility—a $1.9 billion project ballooning to $2.5 billion, with accusations of “lavish” marble upgrades and VIP elevators. However, if one believes this investigation is actually about building materials, they are missing the most significant monetary power play since 1972.

The DOJ’s sudden interest in construction audits acts as a Trojan Horse. The Trump administration has found the one legal weakness in the Federal Reserve’s armor: the definition of “for cause.” They cannot fire Powell for keeping interest rates high. But they can fire him for lying to Congress.

This isn’t an audit; it is a coup d’état by regulatory statute. The victim, consequently, will not just be Jerome Powell’s career, but the stability of the US Dollar itself.

The “For Cause” Trap

To understand why this is happening now, in January 2026, just as the administration is demanding deeper rate cuts, one must look at the Federal Reserve Act.

Under Section 10 of the Federal Reserve Act, the President can remove a Board Governor (including the Chair) only “for cause.” For over a century, legal scholars and the Supreme Court have interpreted this to mean “inefficiency, neglect of duty, or malfeasance in office.” Crucially, it does not include “disagreement over monetary policy.”

This protection was designed to build a firewall between the printing press and the ballot box. A President who wants a short-term sugar high for the economy cannot simply fire the central banker who refuses to print the money.

The Pivot to Malfeasance

President Trump has made no secret of his disdain for Powell’s “higher-for-longer” stance. Attempts to fire him for policy disagreements would trigger an immediate constitutional crisis and a bond market revolt.

Enter “Renovationgate.”

By framing the renovation cost overruns as a matter of perjury, specifically alleging that Powell misled the Senate Banking Committee in June 2025 about the scope of the project, the DOJ is manufacturing the legal grounds for “malfeasance.” Perjury is a felony. A felon cannot serve as the Chair of the Federal Reserve.

The brilliance of the strategy, from a cynical legal perspective, is that it bypasses the policy argument entirely. Attorney General Pamela Bondi doesn’t need to argue that Powell’s 3.75% Fed Funds Rate is bad for the economy. She only needs to prove that Powell misled Congress about the price of marble, effectively successfully weaponizing administrative oversight for monetary ends.

1972 Redux: The Ghost of Arthur Burns

History offers a stark warning, and the ending is an economic horror story. The year was 1972, and President Richard Nixon was facing reelection. He needed the economy to boom, but inflation was creeping up.

Nixon avoided using the DOJ, opting instead for brute force and personal pressure on his appointed Fed Chair, Arthur Burns. The Nixon tapes capture the President telling his budget director that he had pushed Burns as far as he could regarding money supply.

Nixon bullied Burns into keeping interest rates artificially low to fuel a pre-election boom. Burns capitulated. The result was catastrophic:

- Short-term gain: The economy roared into November 1972.

- Long-term disaster: The cheap money unleashed the Great Inflation of the 1970s.

- The hangover: By 1974, inflation hit double digits. The Fed Funds rate, which Nixon wanted low, eventually had to be hiked to nearly 13% to arrest the damage.

The 2026 Parallel

The pressure campaign in January 2026 is less personal and more procedural, but the goal is identical: Fiscal Dominance.

The administration wants lower rates to reduce the servicing cost of the $36 trillion national debt and to stimulate the housing market. Powell has resisted, citing sticky inflation in the services sector. By threatening him with indictment, the administration is sending a clear message to the entire Federal Open Market Committee (FOMC): Cut rates, or face the prosecutors.

If Powell is removed or forced to resign, his replacement will almost certainly be a “dove”—someone chosen specifically for their willingness to lower rates regardless of the inflation data.

The Economics of Capitulation

What happens if the “Trojan Horse” succeeds? If the Fed’s independence is breached, the market will immediately re-price the risk of holding US assets.

The bond market is the smartest room in the financial house. Bond traders know that a politically captured Central Bank always chooses inflation over recession. If the market believes the new Fed Chair is a political appointee, long-term inflation expectations will unanchor.

The Steepener Scenario

Ironically, forcing the Fed to cut short-term rates could cause long-term rates to spike. This is known as a “Bear Steepener.”

If the administration forces the Real Rate (short end) down artificially, Inflation Expectation (long end) will explode. Investors will demand a massive Term Premium to hold 10-year or 30-year Treasuries, fearing their value will be eroded by inflation.

A potential scenario involves:

- Fed Funds rate: Drops to 2.5% (Political Goal)

- 10-Year Treasury: Spikes to 6.0% (Market Reaction)

This would be catastrophic for mortgage rates, which track the 10-year Treasury, not the Fed Funds rate. The administration creates the “renovation scandal” to lower mortgage rates, and ends up doubling them. The very voters the administration hopes to please with “easy money” would find themselves locked out of the housing market entirely, paying 8% or 9% on a 30-year fixed mortgage despite the Fed Funds rate being cut.

The Global Signal: De-Dollarization Accelerates

The implications extend far beyond US borders. The United States Dollar’s status as the global reserve currency rests on two pillars: the depth of its capital markets and the Rule of Law.

Foreign central banks, particularly those in the BRICS bloc, maintain large holdings of US Treasuries because they are considered “risk-free” assets. This “risk-free” status assumes that the US government will not default and that the currency’s value is managed by technocrats, not politicians.

If the DOJ successfully removes a Fed Chair over a dispute regarding building renovation costs, that signal is clear: the Rule of Law in US financial markets is subordinate to political will.

The BRICS Reaction

Precursors to this shift are already visible. In late 2025, central banks in China, Brazil, and India reduced their Treasury holdings, opting instead for gold reserves. A politicized Fed confirms their thesis that the Dollar is being weaponized—not just via sanctions, but via domestic political capture.

If foreign demand for US Treasuries collapses, the US Treasury will be forced to offer even higher yields to attract buyers. This creates a doom loop:

- Foreigners sell Treasuries.

- Yields rise.

- US debt service costs increase.

- The Fed is pressured to monetize the debt (print money to buy bonds).

- Inflation weakens the Dollar further.

- Foreigners sell more Treasuries.

This is the mechanics of a currency crisis. By breaking the independent Fed to “save” the economy, the administration risks breaking the currency itself.

The Verdict: A Dangerous Precedent

The DOJ subpoena served on January 9th is about much more than the Eccles Building’s plumbing. It is a stress test for the rule of law in financial markets.

If the Fed Chair can be removed via a pretextual investigation into administrative expenses, the era of an independent Federal Reserve is effectively over. Every future Chair will know that their tenure depends on keeping the White House happy, not on keeping prices stable.

The renovation of the Federal Reserve headquarters was supposed to secure the building for the next 100 years. Instead, it has become the sledgehammer used to crack the institution’s foundation. Investors should look past the headlines about opulent lobbies and focus on the real story: the U.S. dollar is losing its guardian. The Trojan Horse is already inside the gates, and the soldiers pouring out are not carrying swords, but subpoenas.

🦋 Discussion on Bluesky

Discuss on Bluesky