BREAKING (Dec 30, 2025): Silver prices witnessed extreme volatility on December 30, 2025, following the news, skyrocketing to record highs before a sharp 8.7% intraday correction as markets digest the supply shock.

On January 1, 2026, the global map of clean energy production will hit a significant roadblock. The Chinese government has officially announced a new silver export licensing mandate, a move that effectively weaponizes one of the most critical industrial metals in the world. By requiring government approval for all silver shipments, Beijing is seizing direct control over approximately 60% to 70% of the globally traded refined silver supply.

This isn’t just a bureaucratic update. It is a calculated strike in an escalating export war, aimed squarely at securing domestic manufacturing dominance while leaving the rest of the world to scramble for a dwindling supply of “the new oil.”

The Bureaucratic Siege: 80 Tons or Bust

The new mandate replaces a relatively loose quota system with a set of stringent qualification criteria that most exporters will find impossible to meet. To qualify for a license, a firm must now prove an annual silver production capacity of at least 80 metric tons and maintain credit lines exceeding $30 million.

By setting the bar this high, China is effectively centralizing its silver trade into the hands of a few state-sanctioned giants. Small- and mid-sized firms, which previously acted as the “grease” in the global spot market, are now being frozen out. This centralization allows the state to turn the export tap on or off with surgical precision, using silver as a graduated tool to build strategic influence. It is the same playbook China used for rare earth elements in 2010 and, more recently, for gallium and germanium.

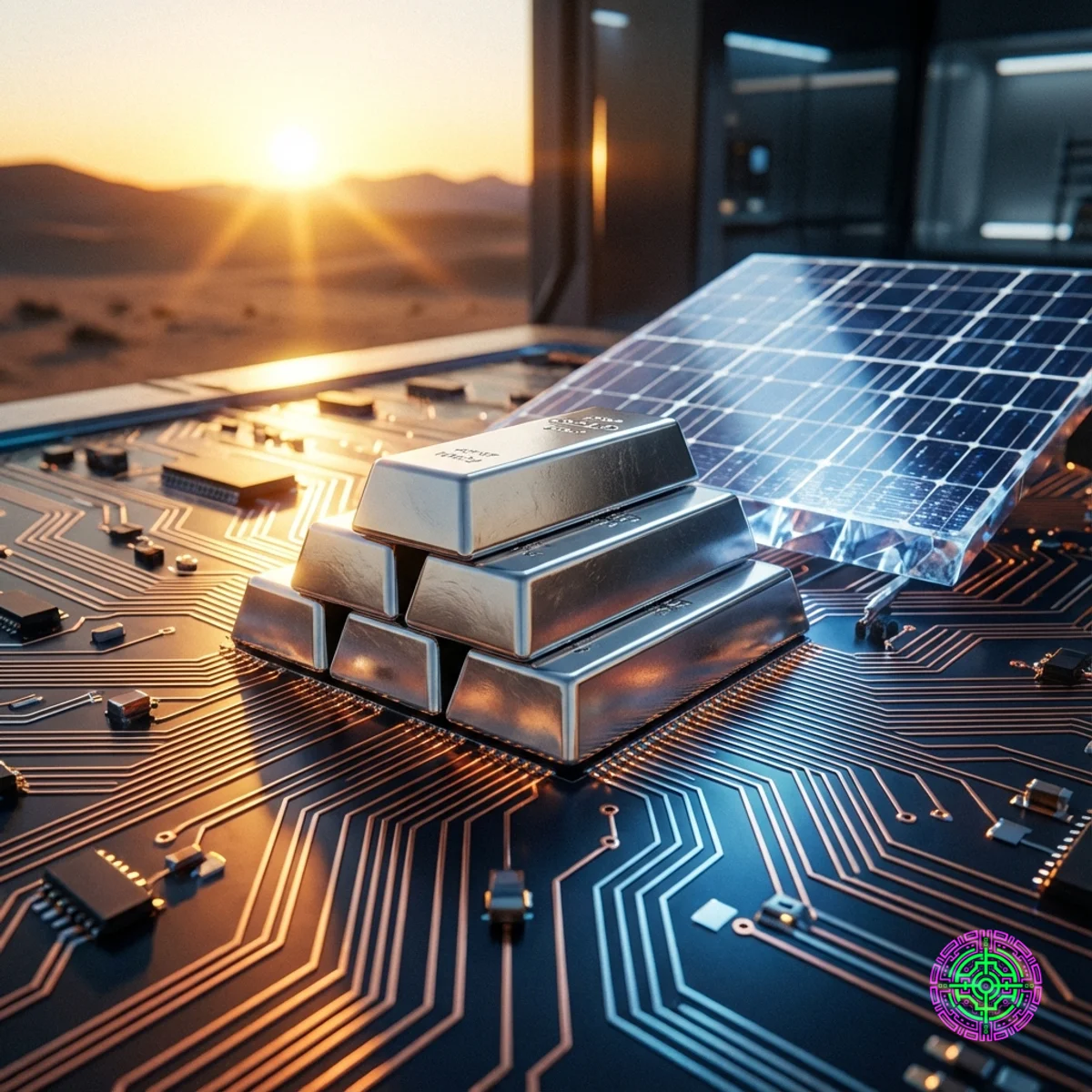

Technical Deep Dive: The Physics of Silver in PV

You might wonder why silver, a metal most people associate with jewelry or antique spoons, is suddenly a “strategic weapon.” The answer lies in the physics of Photovoltaic (PV) cells—the devices that convert sunlight into electricity.

Silver has the highest electrical and thermal conductivity of any element. In a solar panel, it is used in the form of a conductive paste to print the “fingers” and “busbars” that collect the electrons generated when sunlight hits the silicon wafer. Without these silver contacts, the electricity simply wouldn’t have a path to exit the cell.

As the world transitions to more efficient solar technologies, the demand for silver is actually increasing, not decreasing:

- TOPCon (Tunnel Oxide Passivated Contact): This newer technology, which is rapidly becoming the industry standard, requires significantly more silver than the older PERC (Passivated Emitter and Rear Cell) designs.

- HJT (Heterojunction Technology): The “next-gen” of solar cells requires even higher silver loads, often utilizing silver on both sides of the cell.

On average, a single high-efficiency solar panel now requires approximately 20 grams of silver. While that sounds small, consider that China added 216 Gigawatts (GW) of solar capacity in 2023 alone. In 2025, the global solar industry drove a 175% surge in silver demand, contributing to a massive global deficit of over 200 million ounces.

Currently, there is no viable short-term substitute. While researchers are experimenting with copper or aluminum, they often lead to lower efficiency or faster degradation. Until technologies like perovskite solar reach commercial maturity at scale, the world is physically bound to silver.

The Shanghai Premium: A Market Polarized

The impact of this mandate is already visible in the numbers. In December 2025, silver prices in the Shanghai market surged to approximately $85 per ounce, maintaining a persistent $5 premium over Western benchmarks like the COMEX in New York or the LBMA in London.

This price divergence reflects a physical reality: the silver is staying in China. Domestic manufacturers are hoarding supply to feed their massive production lines, while Western inventories are being hollowed out. Historical data shows that COMEX silver stocks have dropped nearly 70% since 2020. With China now formalizing its control, that drain is likely to accelerate.

Industry leaders are taking note. Elon Musk recently commented on the situation, stating “This is not good,” in response to reports of the tightening supply. For companies like Tesla, which rely on silver for everything from EV (Electric Vehicle) power electronics to solar tiles, a restricted supply chain means higher costs and potential production delays.

The Cynic’s Take: The “Two Birds” Strategy

Beyond the bureaucratic hurdles, this mandate serves two distinct but complementary strategic goals.

First, it is an act of Resource Nationalism. By securing the domestic supply of silver, China ensures that its solar giants (like Longi and JinkoSolar) can continue to produce at high volumes and low costs, even as global prices spike. This effectively subsidies their dominance.

Second, it is Annexation by Economics. By starving Western manufacturers of the raw materials they need, China makes it nearly impossible for competitors in the US or Europe to build a self-sufficient solar supply chain. If you can’t get the silver, it doesn’t matter how many “Made in America” subsidies you have; you can’t build the panels.

Forward-Looking Analysis: The Silver Cliff

What comes next? The industry is entering the era of the “Silver Cliff.” As the January 1, 2026, deadline approaches, market analysts expect a final flurry of exports as firms try to get material out before the gate closes. Following that, the global market will likely enter a period of extreme volatility.

For investors, the signal is clear: the era of cheap, abundant industrial silver is over. For policy makers in the West, the mandate is a wake-up call. The global solar dominance of the 2030s isn’t just about who has the best tech; it’s about who owns the dirt—and the metals—that make the tech possible.

China has just claimed the silver. The question is: what will the rest of the world do when the lights go dim on the supply chain?

🦋 Discussion on Bluesky

Discuss on Bluesky