BREAKING (Jan 28, 2026): In a move that silenced the Q4 2025 earnings call, Elon Musk announced the definitive end of the Model S and Model X production lines, effective Q2 2026.

The headline writes itself: “Tesla Admits Defeat in Luxury Market.” It is a clean, easy narrative. Sales of the aging flagship platforms have slumped to under 12,000 units in Q4 2025. This figure represents a rounding error compared to the millions of Model Ys rolling off the line. Critics are already taking victory laps, calling it proof that the “Tesla Magic” is fading under pressure from Lucid, Porsche, and the Chinese luxury wave.

However, those critics are missing the floor plan for the trees.

If one looks past the sales charts to the physical constraints of the Fremont factory, a different story emerges. This is not merely a retreat; it is an eviction. Tesla is not killing the Model S simply because it hates cars. It is killing the Model S because the factory has run out of space, and the landlord, Elon Musk, has found a tenant that pays better rent.

That tenant is Optimus.

The Manufacturing Density Equation

To understand why the Model S had to die, one does not need to be a financial analyst. One needs to be a manufacturing engineer.

The Fremont factory contains 5.3 million square feet of the most valuable industrial real estate in the Western Hemisphere. Every square foot that fails to generate maximum revenue acts as a liability.

The Model S and X lines are dinosaur tracks. Designed in the early 2010s, they function as “manufacturing islands.” These bespoke, low-automation zones require significant manual labor and, crucially, massive amounts of floor space per unit produced. They do not share the efficiencies of the Highland Model 3 or the Juniper Model Y.

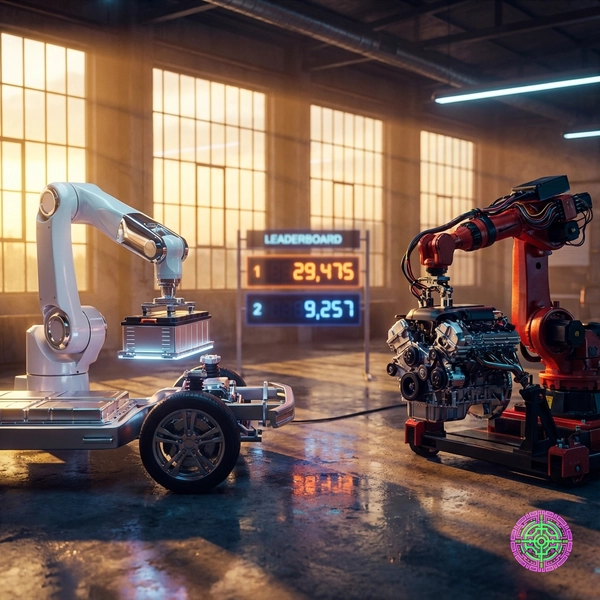

Here is the brutal math of the “Density Eviction”:

| Metric | Model S/X Line (Legacy) | Optimus Line (Projected) |

|---|---|---|

| Footprint Usage | ~800,000 sq ft | ~800,000 sq ft |

| Annual Output | ~45,000 Units (2025) | ~500,000 Units (Target) |

| ASP (Average Selling Price) | ~$85,000 | ~$20,000 (Initial) |

| Revenue per Sq Ft | ~$4,781 | ~$12,500 |

| Labor Density | High (Human Assembly) | Low (Automated Assembly) |

(Estimates based on Q4 2025 production data and stated Optimus manufacturing targets)

By evicting the low-density Model S/X lines, Tesla frees up nearly a million square feet of prime factory floor. They are not just cutting a loss; they are tripling the revenue potential of that specific patch of concrete. The Model S was not killed by the Lucid Air. It was killed by geometry.

The ‘Unboxed’ Incompatibility: Why It Couldn’t Stay

A critical technical factor often overlooked is the incompatibility of the Model S/X architecture with Tesla’s modern “Unboxed” manufacturing process.

The “Unboxed Process,” debuted with the Cybercab and the next-gen platform, revolutionizes auto assembly. Instead of sending a painted body shell down a long line where workers crawl inside to install parts (the “tube” method), the car is built in separate sub-assemblies (front, rear, floor, sides) that snap together at the very end. This reduces factory footprint by 40% and allows for higher automation density.

The Model S and X rely on the “tube” method. Their unibody castings and chassis design date back to 2012. Retooling these legacy platforms to work with the “Unboxed” process would require a ground-up re-engineering effort costing billions—essentially designing a new car from scratch.

Maintaining two completely different manufacturing philosophies under one roof is logistically poisonous. It requires two sets of supply chain logic, two sets of tooling maintenance, and two distinct labor pools. The Model S line was effectively a “factory within a factory,” operating on obsolete logic. By removing it, Fremont becomes a unified facility dedicated to the high-efficiency, high-automation future. It resolves the “Technical Debt” of the physical assembly line.

The Grey Area: Two Truths at Once

Business is rarely black and white, and the death of the S/X acts as the ultimate shade of gray. Two things can be true simultaneously:

Truth 1: The Product Capabilities Failed

The reality is that the Model S and X were on life support. Despite the Plaid refresh, the platforms are 14 years old in spirit. The “stalkless” driving interface alienated buyers, the fit-and-finish never matched the price tag, and competitors strictly caught up. If these cars were printing money with 20% margins and 100k unit volume, Elon Musk would have built a new building for Optimus. The decline made them vulnerable.

Truth 2: The Pivot Required a Sacrifice

Tesla’s stock price (and Musk’s attention) is no longer pegged to automotive margins. It is pegged to AI and Robotics. The market has priced Tesla as a robotics company that happens to sell cars. To justify that valuation, Tesla needs to show physical progress on mass-producing Optimus. They cannot do that in a tent in the parking lot. They need a clean room, high-power lines, and existing logistics infrastructure.

The “Eviction” happens at the intersection of these two truths. The weakness of the car business gave Musk the excuse he needed to make the aggressive bet on the robot business. It is a consolidation of weakness to fund a bet on strength.

The Competitor Vacuum: Who Feeds on the Carcass?

With Tesla exiting the premium sedan and SUV space, nearly $4 billion in annual revenue is now up for grabs. The primary beneficiaries will not be the budget EV makers, but the legacy luxury brands that have finally organized their electric strategy.

Lucid Motors ($LCID) stands to gain the most immediately. The Lucid Air is the only vehicle on the market that matches the Model S Plaid’s range and performance specs while offering the traditional luxury build quality that former Tesla owners often crave. For customers who want a “Techno-Sedan” without the Musk baggage, Lucid is now the default option.

Porsche, with its electric Macan and the updated Taycan, will likely absorb the performance-oriented Model X buyers. These drivers care less about the “Falcon Wing” doors and more about driving dynamics, an area where Porsche has always led.

Rivian ($RIVN) occupies an interesting middle ground. While the R1S is more rugged than the Model X, it appeals to the same “Adventure Tech” demographic. As Model X owners look for replacements that offer three rows and high status, the R1S becomes the logical successor.

Tesla is effectively handing the entire American luxury EV segment to its rivals on a silver platter. They are betting that the “Robot Economy” will be so massive that losing the luxury car war simply won’t matter.

The Historical Rhyme: IBM’s ThinkPad Moment

History provides a clear precedent for this move.

In 2005, IBM sold its ThinkPad division to Lenovo. At the time, tech pundits screamed that IBM was “dying.” How could a computer company stop making computers?

IBM knew something the pundits didn’t: Hardware is a commodity; Services are a monopoly. IBM traded low-margin laptop manufacturing for high-margin enterprise consulting and cloud services. It appeared to be a retreat, but it was a strategic purification.

Tesla is pulling an IBM. They are admitting that the “Luxury Sedan” game is now a low-margin commodity fight against Chinese giants like BYD and Xiaomi. They are bowing out of that dogfight to focus on the sector where they still have a 5-year lead: humanoid robotics and autonomy.

By 2030, the industry may view the Model S Plaid the same way it views the IBM T42 ThinkPad: a legendary machine that marked the end of an era, right before the company became something else entirely.

Second-Order Effects: The Orphan Fleet

The immediate losers in this pivot aren’t the competitors, it is the owners.

Effective Q2 2026, the Model S and X join the “Orphan Fleet.” While Tesla is legally obligated to provide parts for a set number of years, the reality of “end of life” (EOL) manufacturing is grim.

- Parts Scarcity: As supply chains retool for Optimus, getting a falcon-wing door latch or a Plaid drive unit will go from “weeks” to “months.”

- Insurance Spiral: Insurers hate orphan cars. Without a steady stream of new spare parts, “total loss” thresholds drop. Expect premiums for existing Model S/X owners to spike by 15-20% by year-end.

- The Collector Curve: Weirdly, values might spike before they crash. The final “Signature Edition” models rolling off the line in June 2026 will be instant collectibles. But for the 2018 Model 75D in your driveway? The depreciation curve just got a lot steeper.

The Verdict

The Fremont Eviction is ruthless, unsentimental, and risky. Musk is betting the company’s prestige flagship—the car that made EVs cool—on a robot that currently walks like a toddler.

But from a manufacturing standpoint, it is the only move that makes sense. You don’t build the future in a factory clogged with the past. The Kings are dead. Long live the Robot.

🦋 Discussion on Bluesky

Discuss on Bluesky