What Happened

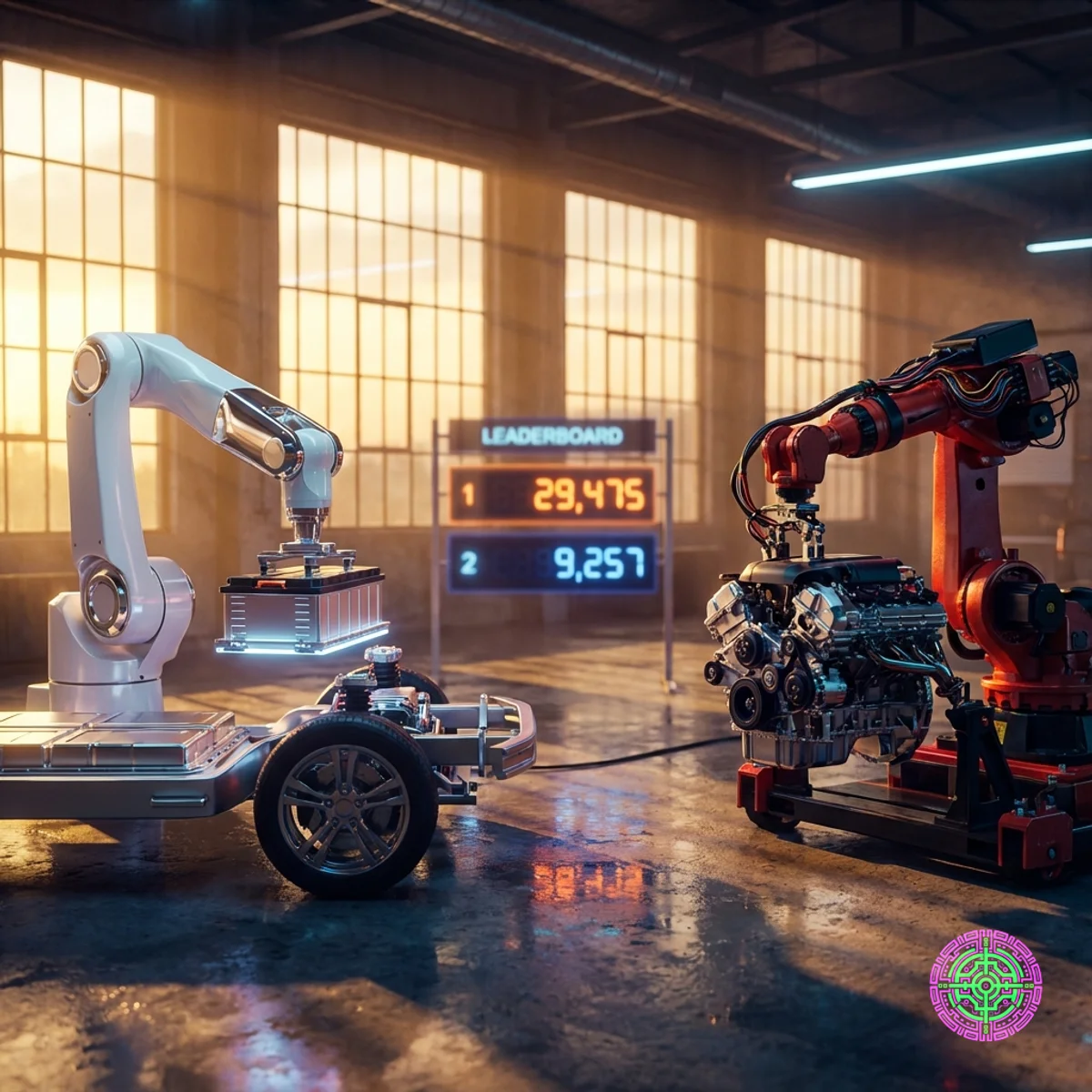

On January 2, 2026, Tesla released its official full-year delivery report, confirming a total of 1,636,129 vehicles delivered in 2025. This marked a significant decline from its 2024 peak, reflecting the expiration of US federal tax credits and a softening global appetite for premium electric vehicles.

Just 24 hours earlier, on January 1, 2026, BYD stunned the market by announcing it had sold 4,602,436 “New Energy Vehicles” (NEVs) in the same period. The mainstream press immediately hailed this as the final dethroning of Tesla, with headlines across the globe claiming BYD is now nearly three times the size of the Elon Musk-led manufacturer.

However, a closer interrogation of the data reveals a massive “Analytical Blind Spot.” The 4.6 million figure from BYD includes over 2.28 million plug-in hybrids (PHEVs)—vehicles that still carry an internal combustion engine (ICE). When you strip out the gasoline-assisted models, the pure Battery Electric Vehicle (BEV) race is closer than it appears, and in the Western world, Tesla is still the undisputed king.

Key Details

- The BEV Breakdown: Once the “PHEV Fudge” is removed, BYD’s pure electric deliveries sit at 2,256,714 units. While this is higher than Tesla’s 1.63M, the gap is measured in a few hundred thousand units, not millions.

- Tesla’s Profit Superiority: Despite the delivery slump, Tesla’s average net profit per vehicle is estimated to remain above $8,000, whereas BYD’s massive volume is driven by low-margin models like the Seagull, where margins can be as thin as $1,500.

- The “Galapagos” Effect: Approximately 80% of BYD’s BEV sales remain trapped inside the Chinese domestic market. In North America and Europe, Tesla still outsells BYD by a ratio of nearly 3:1.

- Energy Pivot: Tesla’s report also revealed a record 46.7 GWh of energy storage deployments for 2025, suggesting the company is successfully pivoting into a “Virtual Power Plant” play to offset declining car demand.

Why It Matters

This is more than a numbers game; it is a battle for the “Investment Narrative.” As long as Tesla can claim it is the leader in “pure” zero-emission transport, it can command a higher valuation multiple. If the public accepts the “BYD is 3x bigger” narrative, Tesla risks being re-rated as a struggling niche automaker.

For Consumers

If you are a car buyer in the West, the BYD threat remains largely theoretical due to 100% tariffs. However, the price pressure from BYD is forcing Tesla into more aggressive discounting, potentially lowering the cost of a new Model 3 in 2026 at the cost of your used car’s resale value.

For the Industry

Detroit is watching this with absolute terror. While they struggle to build any profitable EV, they are seeing a Chinese giant achieve massive scale through a “stealth” hybrid strategy. BYD uses PHEVs to fund the R&D for their BEVs—a strategy legacy makers like Ford are only now trying to replicate.

For Investors

The market is bifurcating. Investors in BYD are betting on logistics and manufacturing volume. Investors in Tesla are betting on AI, FSD (Full Self-Driving), and Energy Storage. Comparing them as “car companies” misses the fundamental divergence in their business models as of Q1 2026.

The Backstory

The battle for the “Sales Crown” began in earnest in Q4 2023, when BYD briefly outsold Tesla in BEVs for the first time. Since then, the two have traded blows. Tesla’s refusal to build a $25,000 “Model 2” has left the bottom half of the market wide open for BYD, which has effectively colonized the “Global South” (Southeast Asia, Brazil, and Africa) while Tesla remains focused on the premium segments.

Expert Reactions

Dan Ives (Wedbush Securities) commented on the results:

“Tesla announced its FY4Q delivery numbers… slightly below consensus but much better than the ‘whisper’ numbers of 410k. The Street will view this as demand stabilizing in a high-interest rate environment. All focus now shifts to the autonomous pivot.”

Gary Black (Future Fund):

“Tesla missed reduced 4Q expectations, and now FY 2026 numbers have to come down. EVs still make up over 75% of Tesla’s operating profits. Autonomy is the future, but the hardware sales still pay the bills.”

What’s Next

The industry is entering the “Post-Hype” era of the EV race. Watch for these three milestones in the first half of 2026:

- Tesla Q1 Earnings: Will the Energy Storage growth be enough to mask the automotive margin compression?

- BYD’s Mexican Factory: Any movement on BYD’s North American production will trigger a major political response in Washington.

- FSD v14 Release: Tesla needs a massive “software win” to justify its valuation in the face of BYD’s manufacturing dominance.

Timeline:

- January 28, 2026: Tesla Full Year Earnings Call.

- February 2026: BYD expected to announce Q1 export targets.

- March 2026: Expected release of FSD v14 to a wider fleet.

The Strategic Perspective

The “PHEV Fudge” is the most effective PR move in automotive history. By bundling hybrids into their totals, BYD has successfully convinced the world they have “beaten” Tesla. They haven’t—at least not yet. Tesla is playing a different game entirely. While BYD is winning at “bending metal,” Tesla is building a distributed energy utility and an AI inference network.

The Bottom Line

BYD is the world’s greatest manufacturing machine, but Tesla is still the world’s most valuable technology platform. Don’t let the hybrid-heavy totals fool you; the real war for the future of transport is only just beginning.

🦋 Discussion on Bluesky

Discuss on Bluesky